The pathway to:

LOW CARBON CEMENT Commercial Liftoff

Cement is the key ingredient in concrete, the most consumed human-made material on earth, and is a vital upstream input for housing, built infrastructure, and a wide range of critical construction projects.

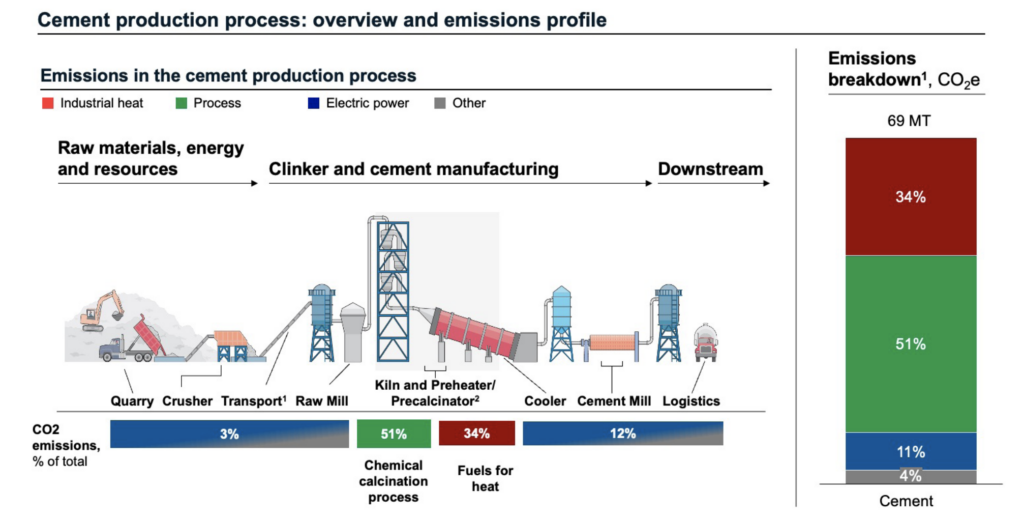

Cement represents ~7–8% of global CO2 emissions and ~1–2% of U.S. CO2 emissions (~70 MT CO2 /year).

Decarbonization presents a significant technical challenge: 85% of emissions are intrinsic to the chemical production process itself or are related to the high heat at which it takes place.

Overview of the cement production process with corresponding emissions by source. 85% of emissions come from clinker production in the preheater/precalciner and kiln, of which 51% are intrinsic to the chemical calcination process and 34% come from the combustion of fuels for heat.

Notes: 1. U.S. EPA. (2021). Facility Level GHG Emissions Data from Large Facilities [Data set]. Visual from Czigler, Thomas, et al. (2020, May). “Laying the foundation for zero-carbon cement.” McKinsey & Company. Laying the foundation for a zero-carbon cement industry | McKinsey.

The U.S. cement industry must accelerate decarbonization progress dramatically to keep pace with sector-wide net-zero goals. Scaling green cement will be critical for the U.S. to achieve net zero overall and will position the U.S. to lead global efforts to decarbonize the sector, including through deployment of U.S.-developed technologies.

Many potential decarbonization approaches are emerging, but nearly all are in pilot stage today in the U.S. and face challenging paths to scale.

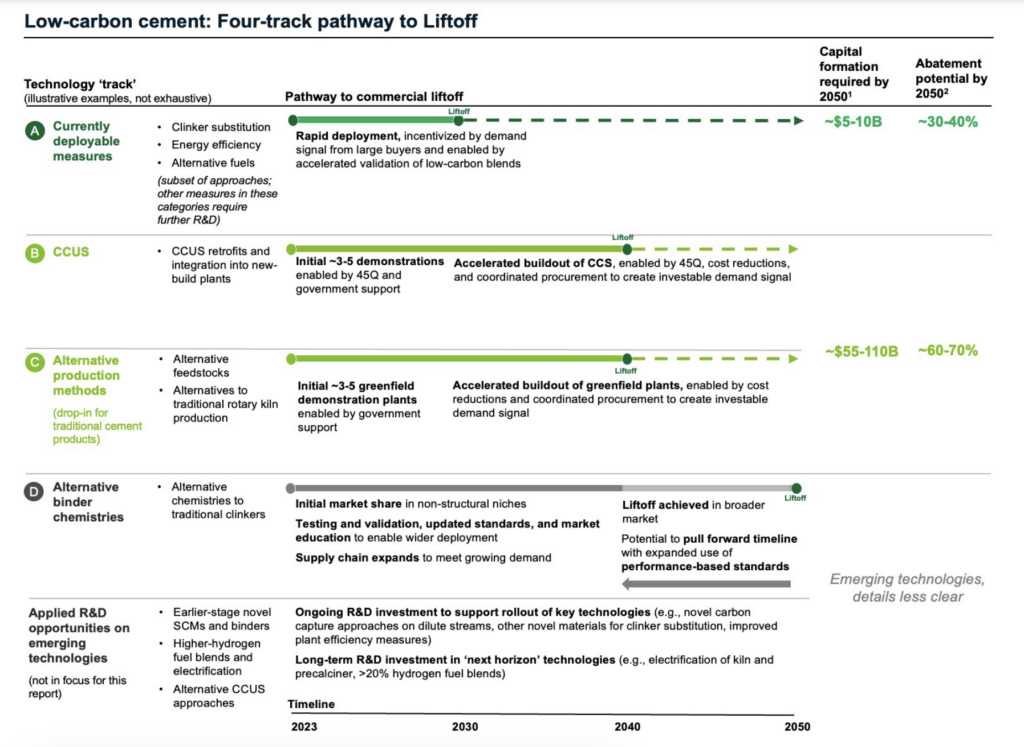

Combined investment across these approaches would need to reach ~$5–20B by 2030 and ~$60–120B cumulatively by 2050 to achieve liftoff of key technologies and then full decarbonization of the cement industry:

- An initial set of clinker substitution approaches, alternative fuels, and efficiency measures could abate ~30% of emissions by the early 2030s and ~40% by 2050, while delivering $1B+ of annual savings to industry, if deployed aggressively. These approaches are broadly at high TRL, deployment-ready, and economically viable today. Scale-up could represent a capital formation opportunity of ~$3–7B.

- Abating the remaining ~60-70% of emissions by 2050 will require approaches that have more difficult economics and still must be demonstrated at commercial scale–namely, carbon capture, utilization, and storage (CCUS) on existing infrastructure and alternative cement production methods.

- Other measures, including alternative binder chemistries to traditional cements, remain more nascent and must achieve further technological maturity and customer acceptance in addition to economic improvements to deploy.

Liftoff for all technologies will hinge on creating a strong demand signal from coordinated low-carbon procurement—a signal that may come from the government through public procurement.

This demand signal will be vital to incentivize the rapid uptake of new technologies, drive aggressive deployment, and mobilize capital at the required scale. Half of U.S. cement demand is driven by federal and state procurement. With their commanding market share, government agencies and large private buyers are in the leading position to send this demand signal and transform the market.

Supported by low-carbon procurement, technologies could follow four parallel ‘tracks’ to liftoff by 2050:

A. Rapid scale-up of clinker substitution, alternative fuels, and efficiency measures from 2023 through the early 2030s, accelerated by low-carbon procurement standards and high-profile demonstrations of low-clinker cement and concrete blends.

B. Full-scale deployment of CCUS retrofits starting in the 2030s, following initial commercial-scale demonstrations in the mid-to-late 2020s. This deployment would be propelled by coordinated procurement from government and large private buyers, structured to enable investment at the multibillion-dollar scale required.

C. Commercial-scale deployment of alternative production methods for traditional cement products in the 2030s, likewise following initial demonstrations and with multibillion-dollar capital formation enabled by coordinated procurement.

D. Longer-term scale-up of fundamental alternatives to traditional cement chemistries, beginning in non-structural, pre-cast, and lower-risk niches and building market share on a longer timeline as standards are updated, market comfort grows, and supply becomes increasingly reliable.

Liftoff pathway for the cement sector is split across technologies with varying technology readiness levels (TRLs) / adoption readiness levels (ARLs) and distinct economic, market, and policy constraints and enablers. Four parallel ‘tracks’ are outlined for different technology types. Other technologies are on a longer timeline and require continuing R&D investment to achieve demonstration and deployment readiness. Track A measures can abate ~30% of emissions by the early 2030s and ~40% of emissions by 2050, while the remaining ~60-70% of emissions will require other technologies in Tracks B, C, and D.

Notes: 1. Capital formation opportunity was estimated according to the methodology detailed in Appendix C and is based on the estimated CAPEX requirement to scale both currently deployable measures and CCUS or alternative production methods across the entire footprint of U.S. cement plants. 2. Abatement potential was estimated using the methodology detailed in Appendix A and assumes the first 30–40% of emissions can be abated by a deployment-ready subset of clinker substitution, alternative fuels, and efficiency measures, with the remaining 60–70% addressed by CCUS and alternative production methods.

Six key challenges must be overcome to scale technologies:

- The market lacks uniform standards to define low-carbon materials and enable informed procurement.

- The sector has a ~10 to 20-year adoption cycle for new blends and materials—both from long lead time needed to update standards and a long customer-adoption cycle.

- The current procurement model is not structured to attract capital at required scale.

- Decarbonization approaches may come with structural cost increases.

- Key technologies have performance and cost uncertainty. Others are at lower TRLs and must make further R&D progress to deploy.

- Projects may lack support from local communities and the public (particularly CCUS projects because of environmental and safety concerns).

Challenges are real but solvable.

Six priority solutions could be pursued:

1. Establish shared standards and data ecosystem for low-carbon products.

2. Make targeted interventions to compress the adoption cycle for new blends and materials to ~5–10 years.

3. Develop alternative procurement models that provide cement projects with firm, long-term offtake commitments to attract risk-averse capital.

4. Develop policy and market models that offset structural costs.

5. For pre-deployment technologies, provide continuing support to accelerate progress along the RDD&D continuum.

6. Implement robust community benefits plans and agreements that are responsive to public concerns, mitigate potential harms, and ensure accountability.

DOE, together with other federal agencies and state and local governments, has tools to address many of these issues and is committed to working with communities and the private sector to accelerate the deployment of green cement technologies, establish the U.S. as a global leader in cement decarbonization, and meet the country’s climate, economic, and environmental justice goals.

Government action will play a critical role in validating new approaches and creating strong demand signals. Bold action is also needed by the private sector, including producers, large-scale customers, and financial institutions, which fund them both, to scale these technologies and fundamentally transform the industry. Companies that move first will be best positioned to capitalize on the potential opportunity to capture demand from low-carbon procurement and position themselves to compete in a decarbonized market.