The pathway to:

offshore wind Commercial liftoff

The U.S. offshore wind market is at an inflection point. Despite recent macroeconomic challenges, the sector is adapting, and improved risk mitigation is being built into industry planning.

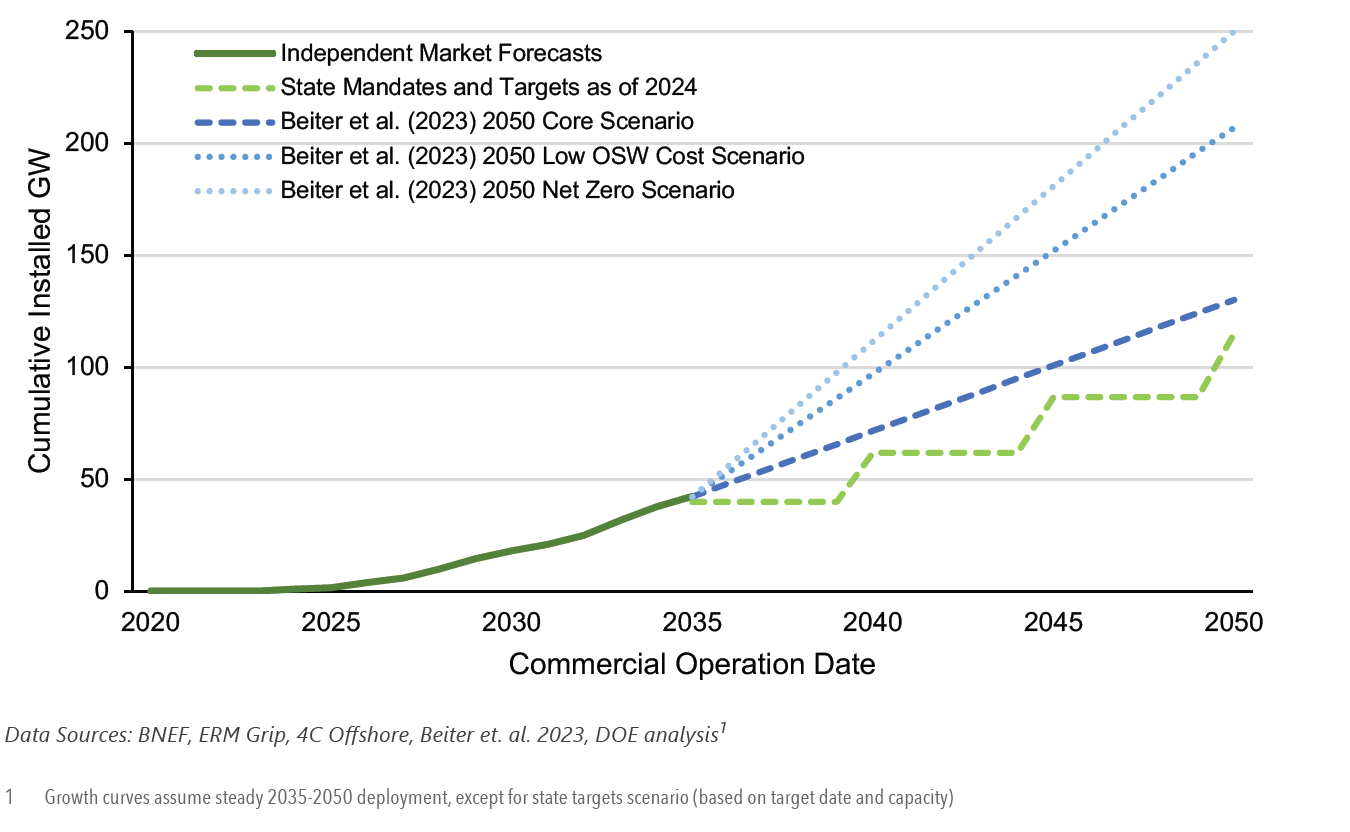

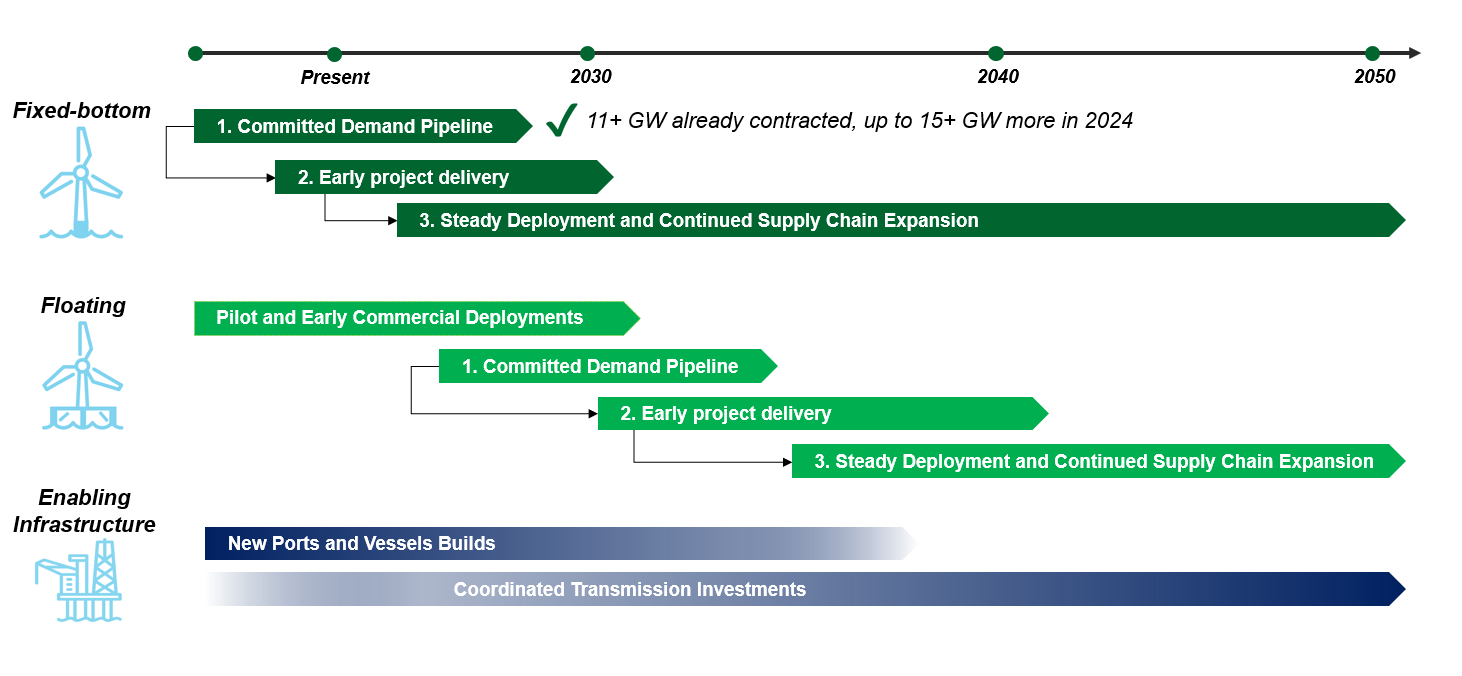

U.S. offshore wind is now poised for Liftoff, beginning with the 10–15 GW of projects with a path to final investment decision in the next few years. These projects will lay the foundation for consistent long-term deployment, decarbonization, and economic benefit across the country. Longer term, offshore wind can deliver over 100 GW clean power by 2050.

There is a clear path to scale, with ~50 GW-worth of U.S. seabed already leased to developers (more planned), and early project deployment advancing rapidly. Delivering over 100 GW by 2050 would require the industry to maintain a steady pace of 4-5 GW deployed per year.

- Offshore wind can deliver tens of GWs of clean power to East Coast load in the near term, with ~250 MW operational, 5 GW under construction, and over 10 GW total approved for construction as of April 2024.

- Offshore wind has a compelling and distinctive value proposition that complements other clean resources, with high capacity factors and strong winter production.

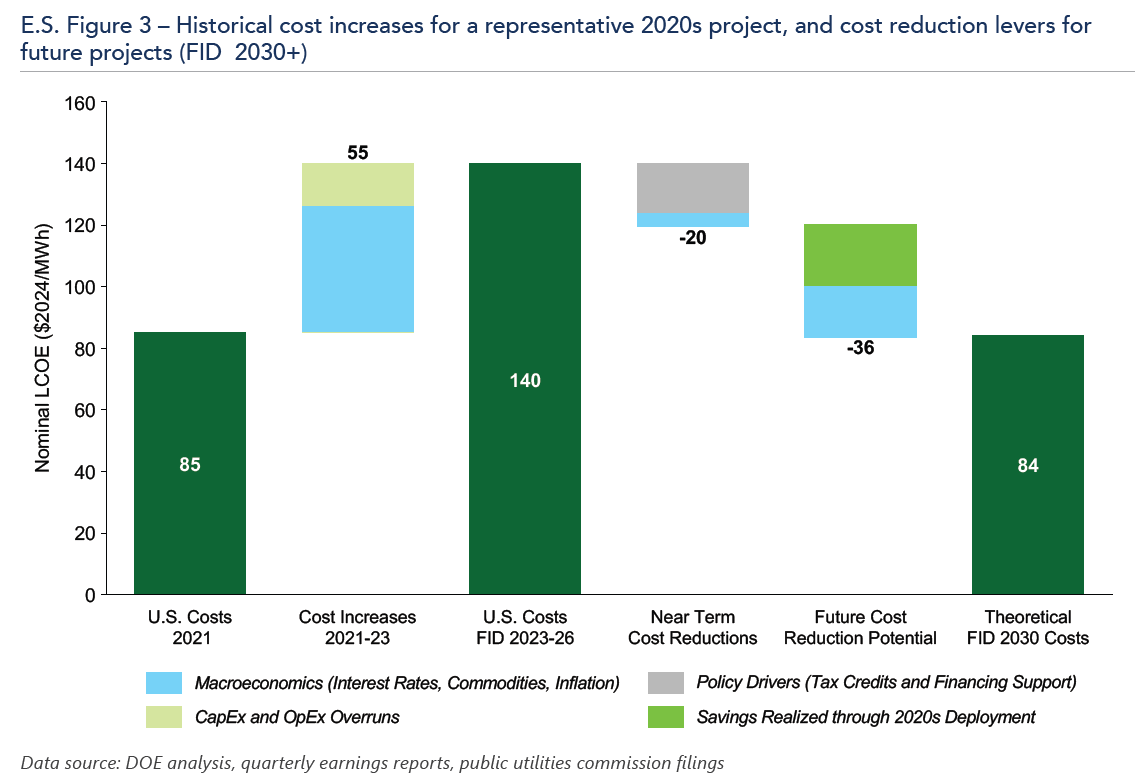

While costs increased over the past few years, there is a path to cost reductions moving forward. LCOEs below $100/MWh ($2024) are possible for fixed-bottom projects by FID 2030. Costs are dependent on macroeconomics, state and federal offshore wind policy, offtake design, and the number of early movers that begin construction in the next few years. The figure above provides a framework to understand near-term cost reduction opportunities—given inherent uncertainties, it should not be interpreted as a forecast.

- Recent cost challenges were driven by rising commodities prices and interest rates, supply chain constraints, and schedule delays. Global cost headwinds have stabilized and new offtake solicitations de-risk development going forward.

- Offshore wind prices reflect not only the cost to generate clean power, but also transmission costs to coastal load centers and the revitalization of maritime infrastructure and manufacturing.

Offshore wind has a compelling and distinctive value proposition that complements other clean resources, with high capacity factors and strong winter production.

THE VALUE OF OFFSHORE WIND

- Commercial technology

- GWs of clean power deployable today

- High capacity factor

- Strong winter generation to match winter peak

- Mature project pipeline & robust state targets

- Energy security

- Economic development & U.S. manufacturing

- Jobs & workforce development

- High growth potential across U.S. waters

- Cost reduction potential

- Transmisson directly to coastal load centers

- Opportunity for necessary grid upgrades

- Revitalizes maritime infrastructure

- Reliability via generation resource diversity

- Relieves siting pressure for onshore renewables

PATHWAY TO COMMERCIAL LIFTOFF

U.S. offshore wind will achieve “liftoff” when the sector is actively contributing to decarbonization targets, with a sustained project pipeline and regular deployment.

CHALLENGES & SOLUTIONS UNDERWAY

The sector faces four major challenges it must overcome to achieve liftoff. Many solutions are already underway, following leadership from State energy agencies, and learnings across the industry.

1. Recent offtake cancellations , driven by macroeconomic conditions, create timing uncertainty and funding gaps for sector buildout.

- Competitive re-bids for 2020s projects that secured offtake pre-2023

- Revised projects that are deliverable under current market conditions, and that reaffirm commitments to fund long-term enabling infrastructure needs (vessels, ports, etc.)

2. Current market structures expose the sector to exogenous risks and require early mover projects to carry the costs and execution complexity of long-term industry buildout needs.

- Improved sequencing of offtake with permitting & project FID

- Offtake refinements to incorporate risk mitigation & prioritize project deliverability

- Targeted investments in enabling infrastructure, especially during the pre-FID funding gap

3. Industry lacks market visibility to plan long-term investment cases, especially for supply chain needs.

- Procurement schedules providing demand visibility & consistency

- Collaboration on regional supply chain & transmission buildout

- Industry consensus on tech specs & standards for supply chain

4. Align economic models and incentives:

- Coordinated POI identification and solicitations for onshore upgrades across multiple OSW projects

- OSW project sizes and standards tailored to low-cost offshore transmission and efficient interconnection

- Mobilization of interregional transmission planning

Offshore Wind Launch Webinar

Join distinguished leaders from the U.S. Department of Energy (DOE) for a webinar on Friday, May 10 at 3:00 PM ET. During this session we will do a deep dive into the Offshore Wind Pathways to Commercial Liftoff report.

The U.S. Department of Energy, in partnership with other federal, state, and local agencies, has tools to address challenges to commercial liftoff and is committed to working with communities and the private sector to build the nation’s clean energy infrastructure in a way that meets the country’s climate, economic, and environmental justice imperatives.