Pathway to Liftoff

Decarbonizing Chemicals and Refining

The U.S. chemicals & refining sectors are key economic drivers, employers, and export commodities.

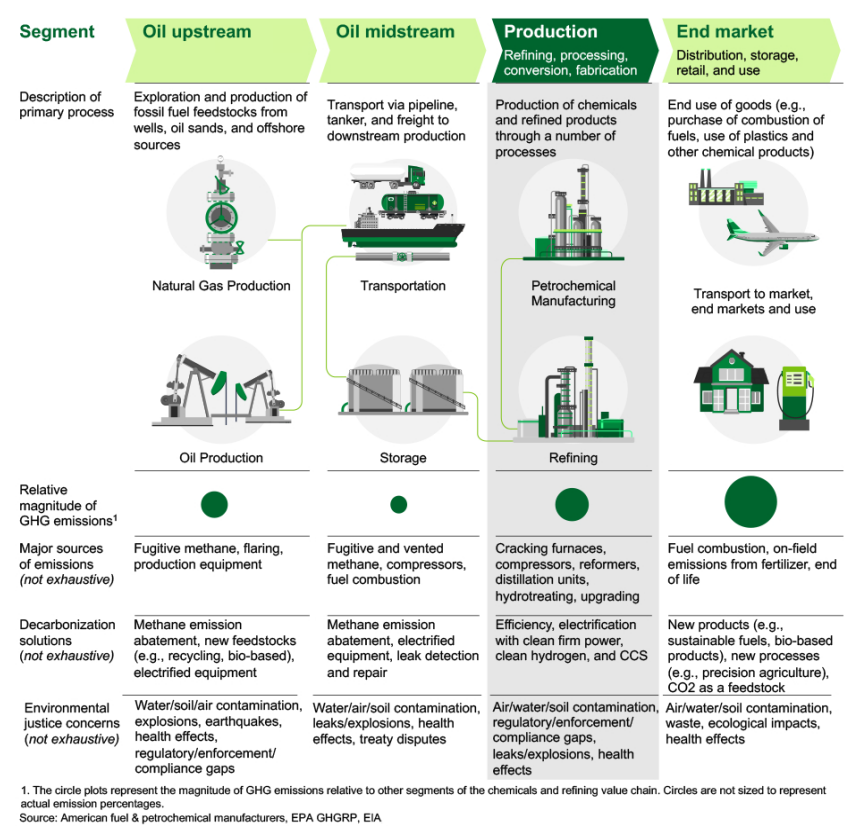

U.S. chemicals production and oil refining contribute ~8% to GDP and are critical for energy security.1 These sectors produce primary fuels for transportation, power, and heat; provide essential inputs to widely used downstream products, including plastics, fertilizer, and pharmaceuticals; and represent major U.S. export commodities.

Chemicals production and refining accounted for ~11% (~533MT) of energy-related carbon dioxide (CO2) emissions in 2021 and ~38% of all industrial energy-related CO2 emissions .i, ii, iii This amount is equivalent to 1.5 times the total emissions of New York State, or one-third of all annual emissions from U.S. transportation.iv, v

The chemicals & refining sectors are not on pace to meet national decarbonization goals. Absent swift and widespread measures to decarbonize production emissions, the chemicals & refining sectors will continue to be major contributors to U.S. emissions over the coming decades.2

A Phased Approach

The decarbonization pathway could evolve over a phased approach to 2050.

2023–2030

Phase 1: Near-term acceleration of deployable pathway enablers

- (i) accelerating energy and operational efficiency measures at most facilities, requiring a ~10% efficiency improvement at >80% of chemicals & refining facilities during this phase

- (ii) adopting select electrification measures with a strong business case today and procuring or developing clean electricity in chemicals & refining facilities to reduce power-related emissions, accelerated with 48E incentives4

- (iii) transitioning steam methane reformers to clean hydrogen in sectors like ammonia production and refining, accelerated with IRA incentives (~3-5 MTPA by 2030)vi, 5

- (iv) installing CCS on high-purity streams (e.g., natural gas processing with streams of >90% CO¬2 concentration), accelerated with 45Q incentivesvii

- (v) Continuing to use existing technologies (e.g., bio-based feedstocks to replace petroleum in existing refineries)6

Together, these levers represent a ~$90–120B investment opportunity by 2030 that could be implemented largely “inside the fence” of existing plants.7 Swift and widespread deployment of these economic measures is critical before turning to more costly measures down the road.8 Past the early 2030s, the path to decarbonization faces a larger cost/performance gap as the industry turns to measures unlikely to clear a ~10% IRR and as credits in the Bipartisan Infrastructure Law (BIL) and Inflation Reduction Act (IRA) begin to expire.

2030–2040

Phase 2: Scaling decarbonization measures currently being demonstrated

- (vi) adopting CCS on dilute emissions streams and

- (vii) rapidly electrifying low- and medium-temperature heat sources

2040–2050

Phase 3: Achieving net zero with technologies currently in R&D and pilot

- Increased overall adoption of clean firm power with storage (e.g., long duration energy storage or thermal energy storage) for low- and medium-heat electrification

- Full adoption of clean hydrogen in ammonia production and significant uptake in refining, with at least 7–8 MTPA of clean hydrogen by 2050 (up from ~3–5 MTPA by 2030)

- CCS on dilute streams could play a critical role in abating the remaining emissions gaps and would be needed to capture up to ~170 MTPA of CO2 in the chemicals & refining sector.

Achieving decarbonization across the chemicals & refining industries will be challenging without end-use shifts by consumers and coordinated efforts across all relevant companies and governments.

The Department of Energy, in partnership with other federal agencies, has RDD&D investments and other demand-side support mechanisms to address the challenges in decarbonizing downstream chemicals production and refining. Finally, DOE is committed to working with communities, labor unions, and the private sector to build a 21st-century industrial base that meets the country’s climate, economic, and environmental justice imperatives.