The *updated* pathway to:

Advanced Nuclear

Commercial LiftOff

US nuclear capacity has the potential to triple from ~100 GW in 2024 to ~300 GW by 2050.

AI and data center load growth is aligning the fundamentals for new nuclear with requirements for 24/7 power, valuing decarbonization, and investment in new generation assets.

In 2022, utilities were shutting down nuclear reactors; in 2024, they are extending reactor operations to 80 years, planning to uprate capacity, and restarting formerly closed reactors.

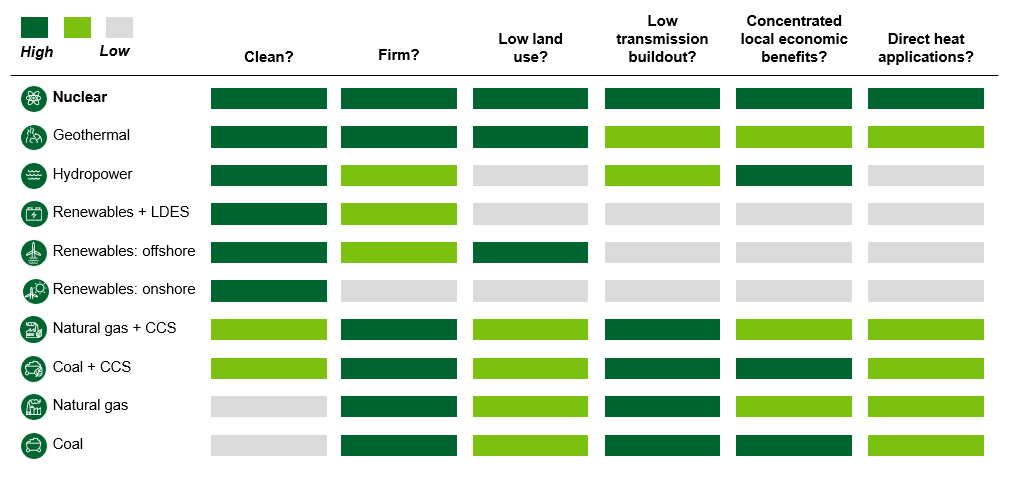

Nuclear provides a differentiated value proposition for a decarbonized grid. Nuclear generates carbon-free electricity, provides firm power that complements renewables, has low land-use requirements, and has lower transmission requirements than distributed or site-constrained generation sources. It also offers high-paying jobs and significant regional economic benefits, can aid in an equitable transition to a net-zero grid, and has a wide variety of use cases that enable grid flexibility and decarbonization beyond the grid, including high temperatures for industrial heat.

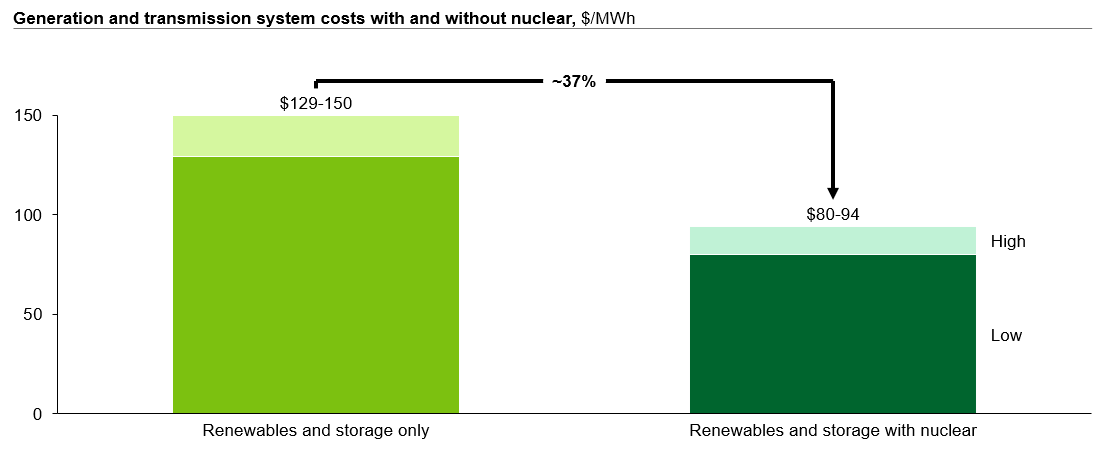

Nuclear has an essential role in the energy transition as a clean firm complement to renewables. Power system decarbonization modeling, regardless of level of renewables deployment, shows the US will need at least ~700–900 GW of additional clean firm capacity to reach net-zero; nuclear is one of the few proven options that could deliver this at scale. Nuclear does not “displace” or “compete with” renewables; decarbonization will require both new nuclear and renewable capacity. Including nuclear and other clean firm resources reduces the cost of decarbonization by reducing the need for variable generation capacity, energy storage, and transmission.

The existing fleet of 94 nuclear reactors at 54 sites provide ~20% of US electricity generation and almost half of domestic carbon-free electricity. Investing in subsequent license renewals is essential for maintaining the existing fleet: of the 94 operating US reactors, 84 have licenses that will expire prior to 2050; 24 have licenses that will expire prior to 2035. Power uprates totaling ~2-8 GW could add near-term capacity to existing reactors. Existing nuclear sites offer significant benefits for siting new nuclear and preliminary analysis shows there may be room for 60-95 GW of new nuclear at existing sites. Multi-unit plants benefit from economies of scale: generating costs at multi-unit plants are 30% cheaper per MWh than single unit plants.

A committed orderbook of 5–10 deployments of at least one reactor design is the first essential step for catalyzing commercial liftoff. These 5-10 reactors should be of the same design as construction costs are largely expected to decrease based on repeat building and learning by doing.

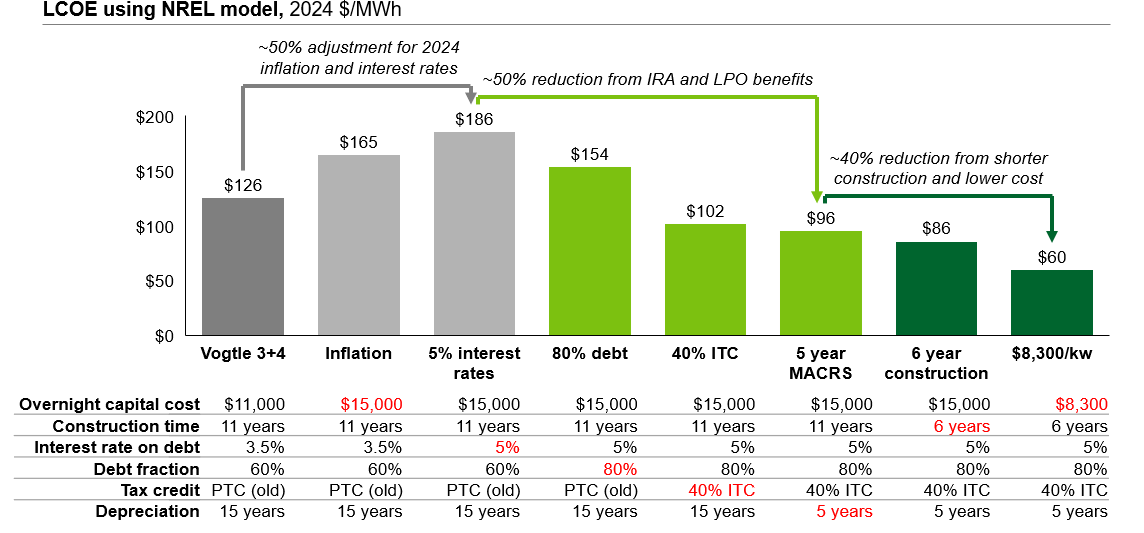

Delivering the first projects reasonably on-time and on-budget will be essential for achieving liftoff of the next wave of nuclear in the US; Vogtle provides essential lessons for project delivery. The completion of Units 3 and 4 made Vogtle the largest clean energy generation site in the US (as well as the largest energy generation site of any kind in the US). The cost of Vogtle Units 3 and 4 is not the correct anchor point for estimating additional AP1000s given costs that should not be incurred again. Vogtle began construction with an incomplete design, an immature supply chain, and an untrained work force; the AP1000 design is now complete, there is now supply chain infrastructure, and Vogtle trained over ~30,000 workers. The next AP1000s would also realize substantial cost reductions with benefits from the Inflation Reduction Act, including the investment tax credit of 30-50% and LPO loans for up to 80% of eligible project costs.

Even assuming Vogtle costs inflated to 2024, next AP1000 could be under $100/MWh with IRA benefits, and closer to ~$60/MWh with cost reductions.

Review the LCOE Model to test the impact of different assumptions and IRA benefits

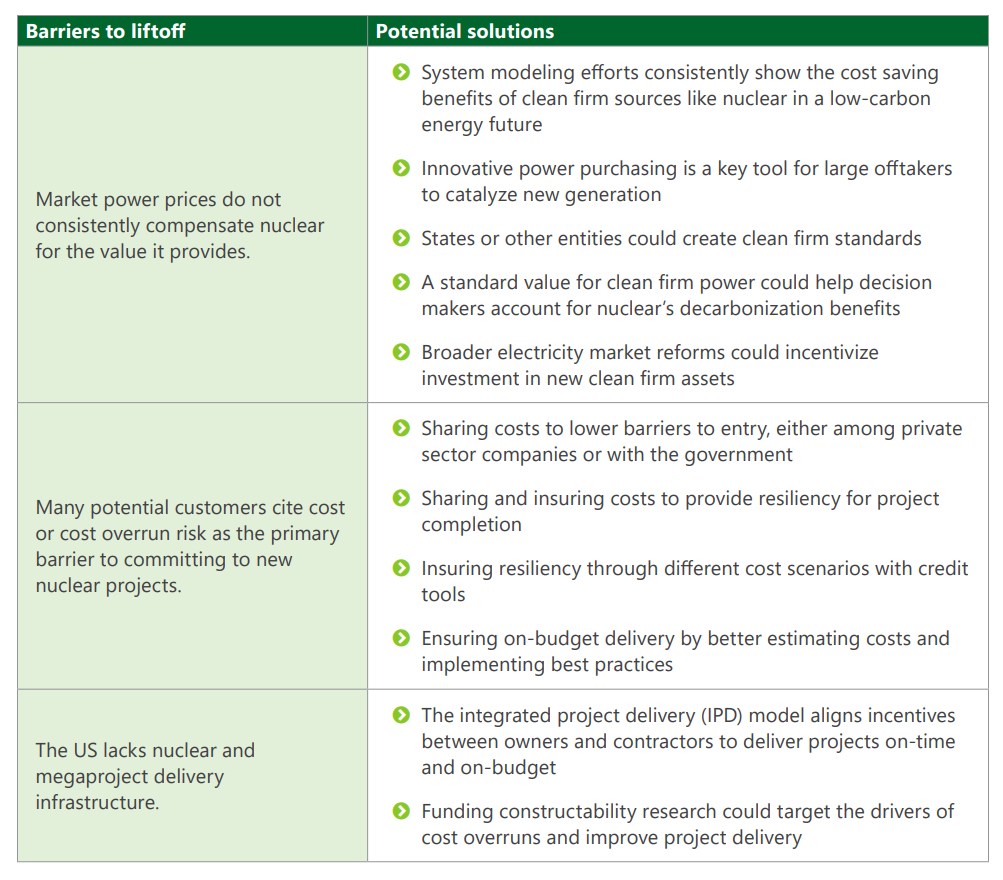

The nuclear industry is building momentum to break the commercial stalemate as utilities and other potential customers see the successful operation of Vogtle Units 3 and 4, anticipate sustained electrical load growth, and internalize IRA benefits. However, the industry must overcome remaining barriers to achieve liftoff.

The U.S. Department of Energy, in partnership with other federal, state, and local agencies, has tools to address challenges to commercial liftoff and is committed to working with communities and the private sector to build the nation’s clean energy infrastructure in a way that meets the country’s climate, economic, and environmental justice imperatives.