The pathway to:

CLEAN Hydrogen

Commercial LiftOFF

The U.S. clean hydrogen market is poised for rapid growth, accelerated by historic commitments to America’s clean energy economy1.

Hydrogen can play a role in decarbonizing up to 25% of global energy-related CO2 emissions, particularly in industrial/chemicals uses and heavy-duty transportation sectors2. Combined, incentives in the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA) can help make clean hydrogen cost-competitive with incumbent technologies in the next 3–5 years for numerous applications3.

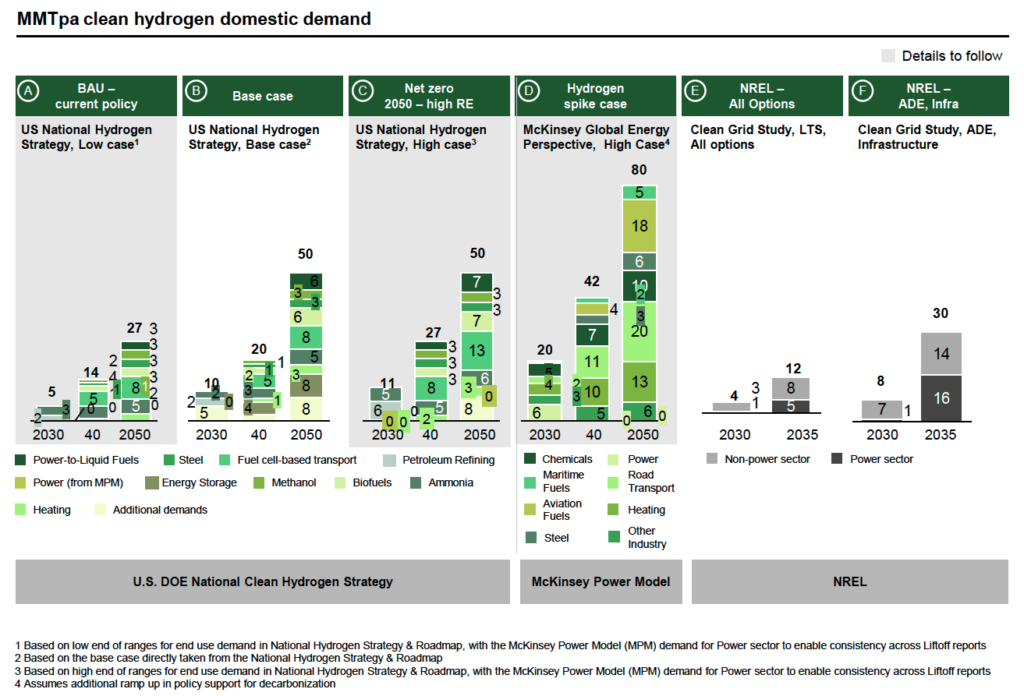

Achieving commercial liftoff will enable clean hydrogen to play a critical role in the nation’s decarbonization strategy. Clean hydrogen production for domestic demand has the potential to scale from < 1 million metric ton per year (MMTpa) to ~10 MMTpa in 20304. Most near-term demand will come from transitioning existing end-uses away from the current ~10 MMTpa of carbon-intensive hydrogen production capacity. If water electrolysis dominates as the production method, up to 200 GW of new renewable power would be needed by 2030 to support clean hydrogen production. The opportunity for clean hydrogen in the U.S., aligned with the DOE National Clean Hydrogen Strategy and Roadmap, is 50 MMTpa by 2050.

See Figure 13 of the Pathways to Commercial Liftoff report for detailed demand scenarios regarding clean hydrogen

In the present policy environment, commercial liftoff for clean hydrogen is expected to take place in three phases:

~2023-2026

Near-term expansion

Commercial Liftoff Phases

Accelerated by the production tax credit (PTC), clean hydrogen replaces carbon-intensive hydrogen, primarily in industrials/chemicals use cases including ammonia production and oil refining. This shift will primarily occur at co-located production/demand sites or in industrial clusters with pre-existing hydrogen infrastructure. In parallel, first-of-a-kind projects are expected to break ground, driven by $8B in DOE funding for Regional Clean Hydrogen Hubs that will advance new networks of shared hydrogen infrastructure.Commercial challenges to overcome

The cost of midstream infrastructure will be highly relevant for use cases where supply and demand are not co-located5. Absence of long-term offtake contracts to manage volume/price risk, uncertainty about cost/performance at scale, permitting challenges, and heterogeneous business models could delay financing for first-of-a-kind projects6. Electrolyzer supply chains, CO2 distribution and storage infrastructure, and a skilled hydrogen workforce will all face pressure to scale.~2027–2034

Industrial scaling

Commercial Liftoff Phases

Hydrogen production costs continue to fall, driven by economies of scale and R&D. Privately funded hydrogen projects come online. Build-out of midstream distribution and storage networks will connect a greater number of producers and offtakers, reducing delivered cost and driving adoption in new sectors.

Commercial challenges to overcome

If not resolved earlier, the growth challenges faced above will be exacerbated during industrial scaling. The pace of clean electricity deployment will be a key driver of hydrogen production technology mix. For water electrolysis, availability of clean electricity and bottlenecks in electrolyzer components/raw materials will play a critical role in the pace of growth. If electrolysis projects fail to scale and realize cost reductions during the IRA credit period, electrolysis may not achieve the necessary learning curves to remain competitive in the absence of tax credits. Each sector converting to clean hydrogen will also face its own opportunities and challenges. For example, fuel cell heavy-duty truck adoption will be highly dependent on the build-out of refueling infrastructure, advancements in fuel cell vehicle technology, certainty of hydrogen supply, and the cost of alternatives (e.g., diesel, battery electric vehicles and their associated costs of charging infrastructure) and regulatory drivers. On the financing side, perceived credit risk will be high for hydrogen project while these challenges remain unresolved; this may also delay the entry of low cost capital providers into the market.

~2035+

Long-term growth

Commercial Liftoff Phases

A self-sustaining commercial market post-PTC expiration will be driven by falling delivered costs. These cost declines translate to a reduction in hydrogen production costs, excluding the PTC, from $3–6/kg today to $1.50–2/kg by 20357.

Commercial challenges to overcome

Post-PTC expiration, competitiveness will rely on production and distribution cost declines achieved through the IRA credit period. Development of mature financial structures and contract mechanisms to mitigate the remaining risks (e.g., price volatility) and crowd-in institutional capital will also be needed8.

Cross-cutting solutions, including DOE H2Hubs, will accelerate market uptake:

Invest in the development of hydrogen distribution and storage infrastructure

initially through centralized hubs and later through distributed infrastructure. Dispersed infrastructure will unlock use cases for hydrogen where production/offtake are not co-located, connecting new offtakers to regional hydrogen networks.

Catalyze supply chain investments

including in domestic electrolyzer manufacturing, recycling, and raw materials/components for electrolyzer production9.

Develop regulations for a scaled industry

including methods of lifecycle emissions analysis across feedstocks and production pathways. These policy and regulatory developments, along with many others (e.g., changes that would streamline project permitting/siting), would take place across both federal and state agencies and would provide critical certainty to accelerate private investment.

Standardize processes and systems across the clean hydrogen economy

private sector standards organizations will play a critical role in driving cross-industry standard operating procedures (SOPs), certifications, and component interoperability (e.g., at refueling stations) to accelerate project development and reduce costs.

Accelerate technical innovation through R&D

to bring down costs and mitigate bottlenecks in some technologies (e.g., platinum group metals for PEM electrolyzers). R&D is also needed to bring down the cost of carbon capture, utilization, and storage for reformation-based production as well as in end-use applications such as improving fuel cell durability.

Expand the hydrogen workforce

with the engagement of companies that have preexisting expertise in safe hydrogen handling (e.g., industrial gas, chemicals, oil & natural gas) as well as labor unions with the skilled workforce and relevant training programs to rapidly expand the workforce.

Expand and accelerate the capital base

using mechanisms that manage price and volume risk (e.g., price discovery via a hydrogen commodity market, hedging contracts) and encourage long-term offtake.

The U.S. Department of Energy, in partnership with other federal, state, and local agencies, has tools to address challenges to commercial liftoff and is committed to working with communities and the private sector to build the nation’s clean energy infrastructure in a way that meets the country’s climate, economic, and environmental justice imperatives.