The pathway to:

Sustainable Aviation Fuel Commercial Liftoff

Aviation represents roughly 3.3% of total U.S. greenhouse gas emissions and jet fuel consumption is forecasted to increase by 2-3% annually through 2050.

SAF is the only viable solution to meaningfully decarbonize our aviation sector in the near-term.

There is growing momentum for Sustainable Aviation Fuel (SAF) production in the U.S.

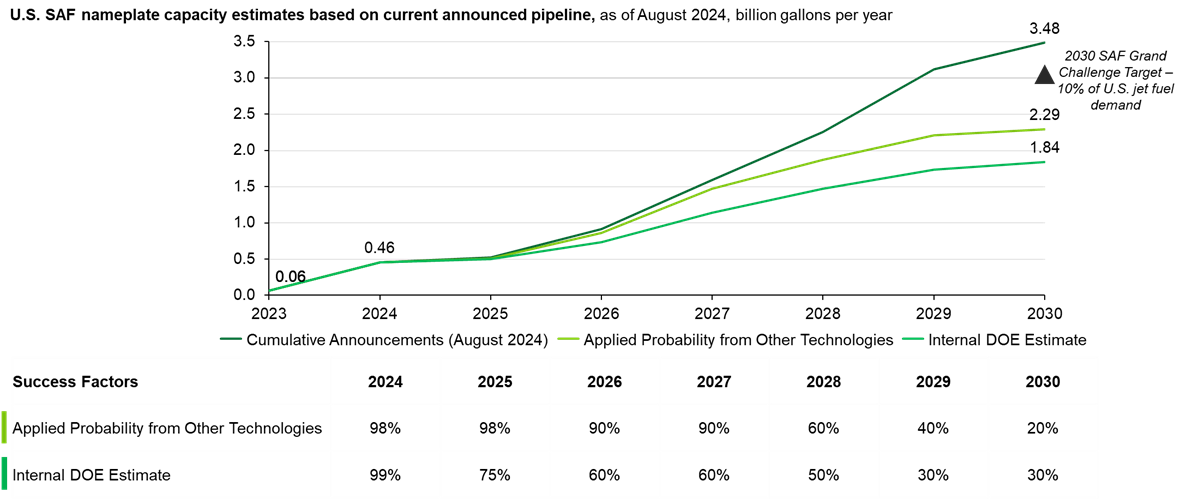

In September 2021, the U.S. established the SAF Grand Challenge, which set a target of three billion and thirty-five billion gallons of annual SAF production in 2030 and 2050, respectively. These targets represent 10% and 100% of projected U.S. jet fuel demand.

Today, announced projects represent over three billion gallons of annual domestic SAF production capacity by 2030, surpassing the U.S. SAF Grand Challenge Target. This announced capacity correlates to over 10% of projected U.S. jet fuel demand, over $44 billion of investment, and over 70,000 jobs across the SAF value chain through 2030.

Total U.S. SAF production volume will depend on factors including federal and state policy decisions, airline commitments, and demand for alternative low-carbon fuels (like renewable diesel) that use the same or similar feedstocks.

What is Sustainable Aviation Fuel (SAF)?

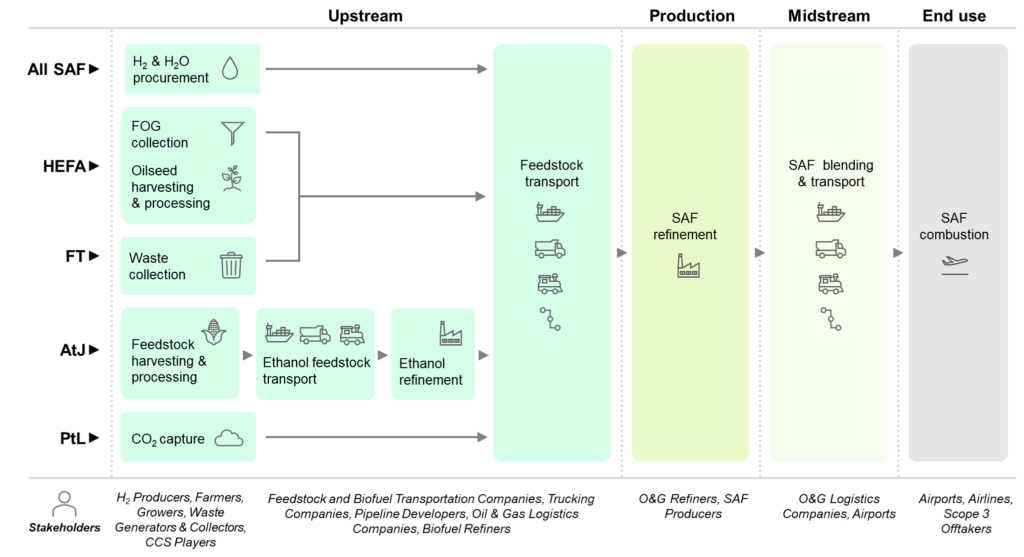

SAF is a drop-in jet fuel replacement. Chemically, it is similar to fossil jet fuel and it can be transported, stored, and burned nearly identically. However, unlike fossil jet fuel – which is made from kerosene – SAF is made from biomass, waste or clean synthetic resources. Feedstocks can be converted into SAF using different technologies. The below figure includes four of the most frequently cited conversion pathways and their most common feedstocks. Different countries have different specifications for SAF, including whether it can be produced from food or feed feedstocks like corn. U.S. policy towards SAF is feedstock agnostic, although the resulting SAF must result in at least a 50% reduction in lifecycle emissions compared to fossil jet fuel.

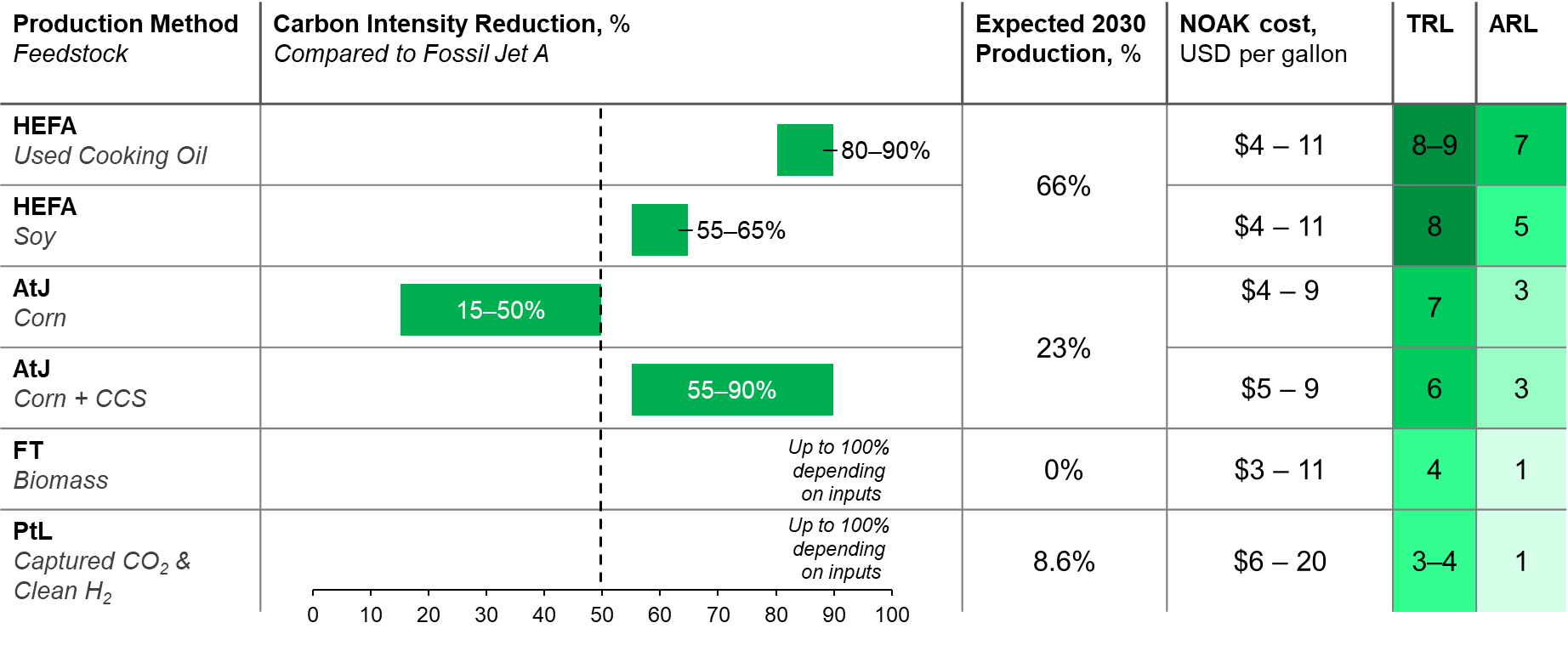

SAF liftoff will require the early deployment of production technologies and feedstocks that are readily available today; additional R&D is needed for pathways that may have fewer feedstock limitations or higher emissions reduction potential. In 2030, biofuels will make up the significant majority of SAF production, with Hydroprocessed Esters and Fatty Acids (HEFA) and Alcohol-to-Jet (AtJ) SAF representing 70% and 10% of total output, respectively. Waste-to-gas processes like Fischer-Tropsch and Gasification (FT) and eFuels production through power-to-liquid conversion technology are unlikely to be deployed at commercial scale prior to 2030 but should be supported today so that they can support the SAF markets in the decades thereafter, especially as biofuel feedstocks become limited.

Today, SAF must be blended with fossil jet before it can be used in aircraft. The American Society for Testing and Materials (ASTM) requires that SAF not exceed 50% of jet fuel blend; the remaining 50%+ must come from fossil jet. Chemical and mechanical engineers are working to safely and legally produce 100% SAF blends.

The Cost of Clean Flight

SAF currently costs 2-10 times more than fossil jet fuel, depending on the technology and pathway used to produce it.

Airlines today operate with single-digit profit margins and cannot voluntarily afford the price premiums associated with SAF at scale. As a result, voluntary SAF demand has been short-term and low volume. Structural challenges also persist in bringing SAF to airports for end-use, further limiting demand. Part of the price premium can be bought down by third parties: corporate offtakers looking to inset or offset their Scope 3 emissions, or airline passengers. However, book & claim systems – systems in which the fuel can be separated from its environmental attribute to create a standalone certificate or SAFc that represents the fuel’s carbon abatement – are not universally accepted, which limits corporates’ demand for SAF. Furthermore, the Greenhouse Gas Protocol (GHG Protocol) and Science-Backed Targets Initiative (SBTi) do not currently authorize SAFc as a viable Scope 3 reduction solution.

Clearing for Takeoff Liftoff...

Three imperatives must be met:

SUPPLY

DEMAND

POLICY

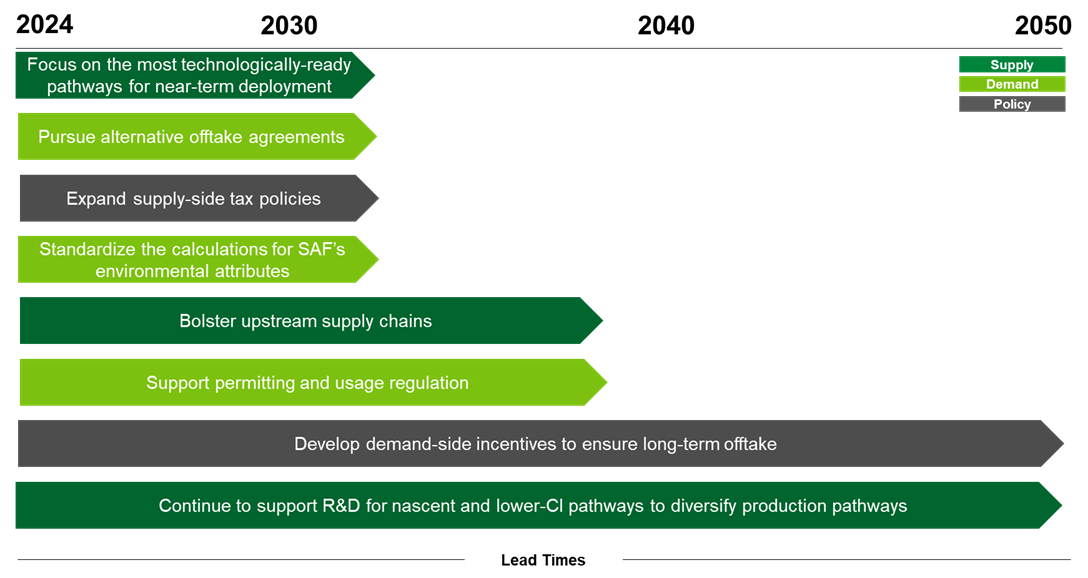

Scale Supply

Today, there are only four commercial SAF projects in operation with a combined nameplate capacity of 64 million gallons per year (MGPY). As of August 2024, only 16.5 million gallons of SAF has been produced this year. Liftoff can be achieved with 800-1,200 MGPY of production. However, production must be distributed across at least 8-12 commercial-scale plants.

8-12 commercial-scale projects, averaging 100 MGPY of production each, will allow producers to experience higher success rates and enjoy learning curves and other cost reductions to shift SAF from FOAK (first of a kind) to NOAK (nth of a kind) facilities. At an average 100 MGPY each, these facilities will create enough feedstock demand to shore up upstream supply chains (feedstock production and collection). They will also streamline midstream logistics, including fuel blending, transport and storage.

This report focuses on scaling and deploying existing SAF technologies (e.g., HEFA and AtJ pathways) to accelerate liftoff by 2030. In parallel, investments in next-generation SAF (e.g., next-generation feedstocks, innovative SAF technologies and pathways, etc.) are essential to meet 2050 targets.

Increase Long-Term Demand

Short-term offtake might benefit the few SAF production facilities already in operation, but 10-year offtake agreements will establish the demand certainty needed both to improve financing terms for developers and encourage greater investment across the SAF value chain, supporting supply.

In the near-term, the SAF industry must activate third-party corporate offtakers. Standards bodies must approve of SAFc for insets and offsets, and book & claim systems should be widely adopted. What follows is a reconfiguration of SAF pricing – from dollars per gallon to dollars per ton. Airlines can procure the low-carbon fuel at or near price parity with fossil jet, and Scope 3 offtakers can cover the full price premium, which is competitive on a per-ton basis with Direct Air Capture (DAC) and other premium offsets.

The below highlights hypothetical nth of a kind (NOAK) costs for SAF sold in California.

Shore Up Supportive Policy

A supportive network of long-term incentives and mandates will help clear the path to liftoff. In the U.S., federal tax credits from the Inflation Reduction Act (IRA) complement the federal Renewable Fuel Standard (RFS) and state policies, including low carbon fuel standards, and help lower costs. Several of these key policies are short-term today. Current foreign mandates provide necessary but insufficient demand pull; adopted mandates result in one billion gallons of SAF demand by 2030. Other solutions that could stimulate demand in the near-term include contracts-for-difference programs and advanced market commitments.

If each stakeholder group does its part, then SAF is on track to reach commercial liftoff by 2030 and market maturity by 2050.

The U.S. Department of Energy, in partnership with other federal, state, and local agencies, has tools to address challenges to commercial liftoff and is committed to working with communities and the private sector to build the nation’s clean energy infrastructure in a way that meets the country’s climate, economic, and environmental justice imperatives.