Pathways to Commercial Liftoff Topic Brief: How New Energy Technologies Can Address Rising Electricity Demand

Electricity demand is expected to grow ~15-20% in the next decade and double by 2050 – driven by economic development (manufacturing and industrial growth, data center expansion) and beneficial electrification (transport, building, industrial).

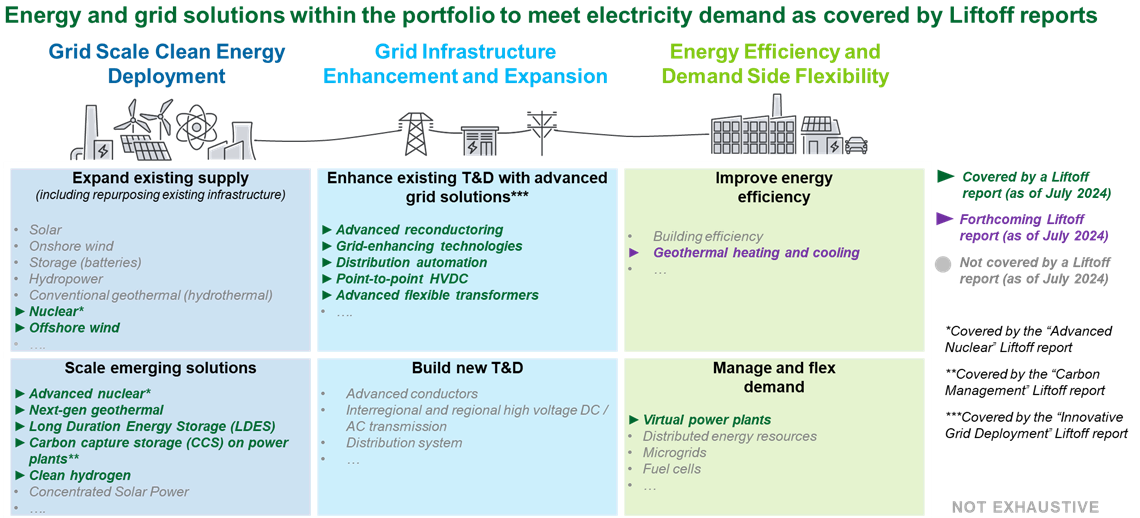

Investing across each segment of the power system – from bulk power generation and storage through the transmission and distribution delivery system and to distributed resources and end-user efficiency – is critical to comprehensively support demand growth. DOE’s 2024 Future of Resource Adequacy report further outlines the portfolio of technology solutions available and necessary enablers (e.g., modernizing interconnection processes, evolving grid market frameworks) to meet electricity demand needs while maintaining a reliable, affordable, and secure grid.

Addressing rising electricity demand requires a portfolio approach to meet near-term demand with commercially available technologies while paving the way to support long-term growth.

DOE’s Pathways to Commercial Liftoff series (“Liftoff reports”) identifies what it takes to reach commercial deployment at scale for multiple available and emerging energy and grid solutions that are part of this broad portfolio.

Today, solar PV, land-based wind, battery storage, and energy efficiency solutions are some of the most readily scalable and cost-competitive resources to meet rising demand. In addition to continued investment in these resources and expanding grid delivery infrastructure, scaling other energy and grid solutions – such as those covered by the Liftoff reports (e.g., next-generation geothermal, nuclear, grid-enhancing technologies, virtual power plants) – will also be critically important to ensure a cost-optimal, diverse portfolio of resources are readily available to reliably meet demand over time.

Rising Electricity Demand Elevates the Need for Liftoff

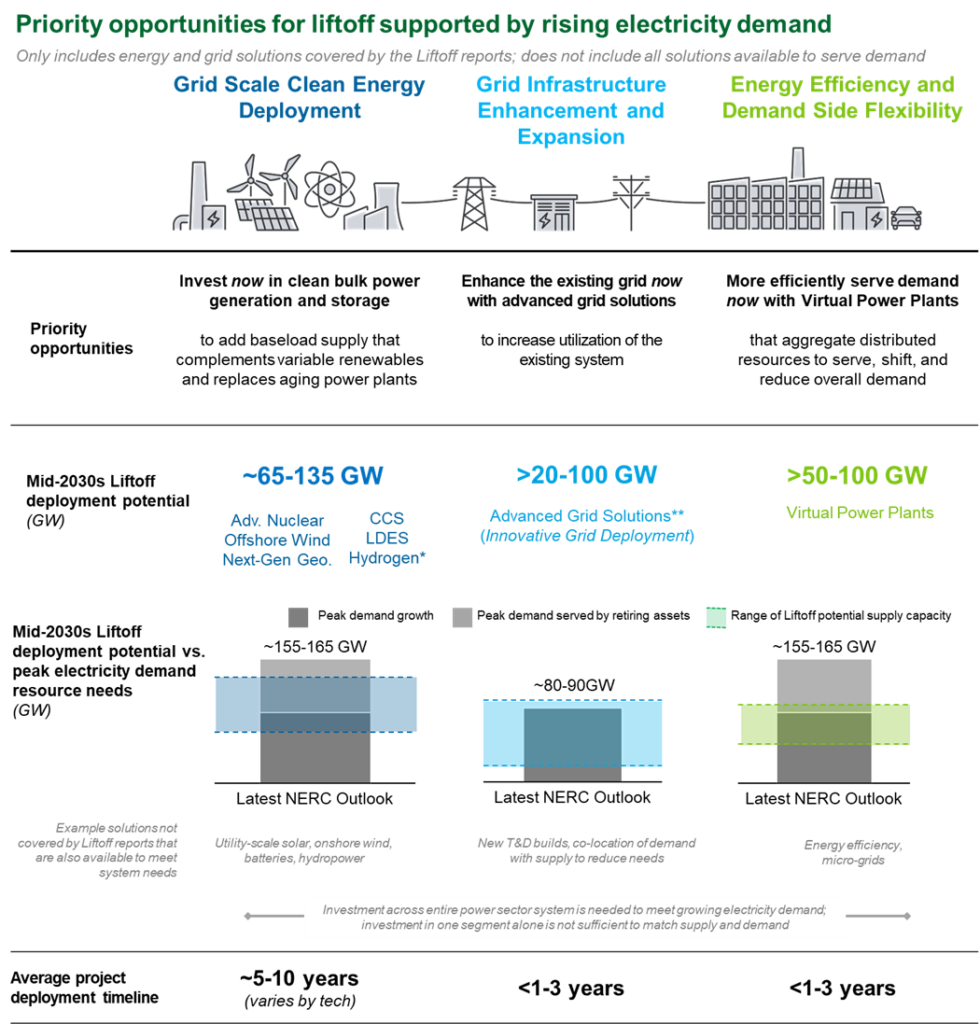

For this subset of energy solutions covered by the Liftoff reports, rising demand today supports three opportunities that industry can pursue to help address power needs in the near term and enable the solutions needed for the long term. Accelerating liftoff for these technologies could collectively add hundreds of gigawatts of capacity on the system to meet demand needs by the mid-2030s.

Priority Liftoff Opportunities

Liftoff Opportunity: Invest now in bulk power generation and storage

Investment in continued research, development, demonstration, and deployment of the power generation and storage solutions covered by the Liftoff reports must continue and expand in the near term so that these technologies are deployed at scale by 2050 to meet long-term needs. At scale, these technologies can provide essential firm capacity to meet demand and other grid services to integrate variable renewable energy resources. Completing the current pipelines for offshore wind and carbon capture storage projects and significantly investing in other generation and storage solutions (e.g., advanced nuclear, next-generation geothermal, long duration energy storage) could add ~65-135 GW capacity to the grid by the mid-2030s. These technologies could collectively deliver an estimated 650-1,300 GW capacity by 2050.

Liftoff Opportunity: Enhance the existing transmission & distribution grid now with advanced grid solutions

Rapidly scaling commercially available advanced transmission and distribution solutions (e.g., advanced conductors, grid-enhancing technologies, system automation technologies) can increase the flexibility, efficiency, and effective capacity of the existing transmission & distribution grid. Full potential deployment of these advanced grid solutions could unlock upwards of ~20-100 GW system capacity on the transmission and distribution system to support rising demand (based on individual technology potential; significant additional capacity is possible if advanced grid solutions are deployed in combination).

Liftoff Opportunity: More efficiently serve demand now with Virtual Power Plants

Accelerating deployment of commercially available virtual power plants (VPPs) can support demand growth by more efficiently balancing the timing of demand with available supply and leveraging distributed resources. Most VPPs can be quickly deployed on the grid to meet near-term needs. Building on the existing 30-60 GW capacity of VPPs, an additional 50-100 GW of VPP capacity could be added to the grid by 2030, with additional capacity potential possible by 2035.

Cross-Cutting Solutions

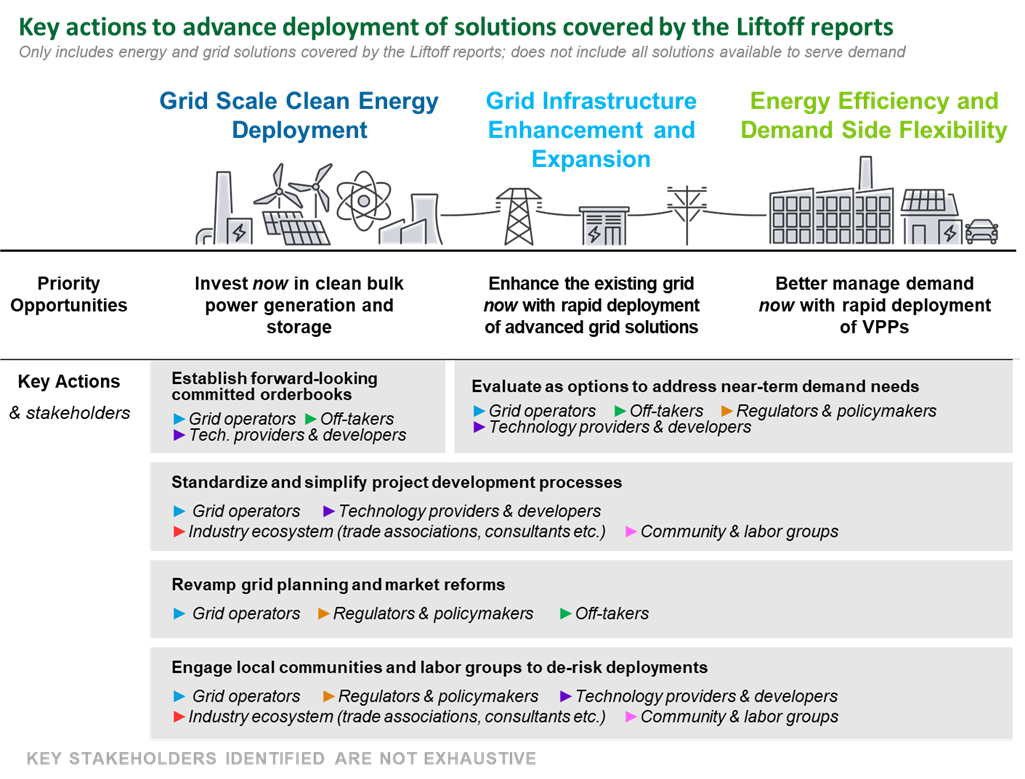

Near-term electricity demand growth is a major opportunity, particularly for early movers in the investment and technology communities, to both accelerate and benefit from the scale-up and broad commercial deployment of these energy solutions covered by the Liftoff reports.

Industry momentum is building with Duke Energy recently announcing an agreement with Amazon, Google, Microsoft, and Nucor to explore innovative financing structures that can support deployment of new carbon free energy generation (such as advanced nuclear) and Colorado policymakers signing a bill to create a VPP program by February 2025.

Building on this momentum, progressing actions that mitigate cross-cutting challenges can unlock progress across multiple sectors at once.

Industry – including utilities, grid operators, and large-load customers (e.g., data centers, manufacturers) – with support from federal and state policymakers and regulators can proactively prioritize these technologies to ensure investment flows towards improved energy solutions. Leveraging unprecedented federal funding and technical resources in combination with private sector capital can scale the ready-to-go technologies to help meet near-term demand and continue expanding investment in emerging sectors to support long-term needs.

Want to learn more about electricity demand growth?

The U.S. Department of Energy, in partnership with other federal, state, and local agencies, has tools to address challenges to commercial liftoff and is committed to partnering with the private sector to lead the commercialization of affordable energy resources while proactively responding to the nation’s growing energy demand.