The pathway to:

Clean Hydrogen

Commercial Liftoff

Clean hydrogen* plays a key role in the decarbonization of both industrial sectors, like steelmaking and petrochemical processes, and transportation sectors, like aviation fuels and heavy-duty trucking. It may also serve as a key long-duration storage technology to meet rising electricity demand. It can be produced using different technologies, including but not limited to: electrolysis powered by clean electricity, natural gas reforming with carbon capture processes, methane pyrolysis, co-production with chlor-alkali, and even mining, as clean hydrogen can be formed geologically underground.

*Clean hydrogen results in a lifecycle emissions rate of less than 4 kilograms (kg) of carbon dioxide equivalent per kg of hydrogen produced.

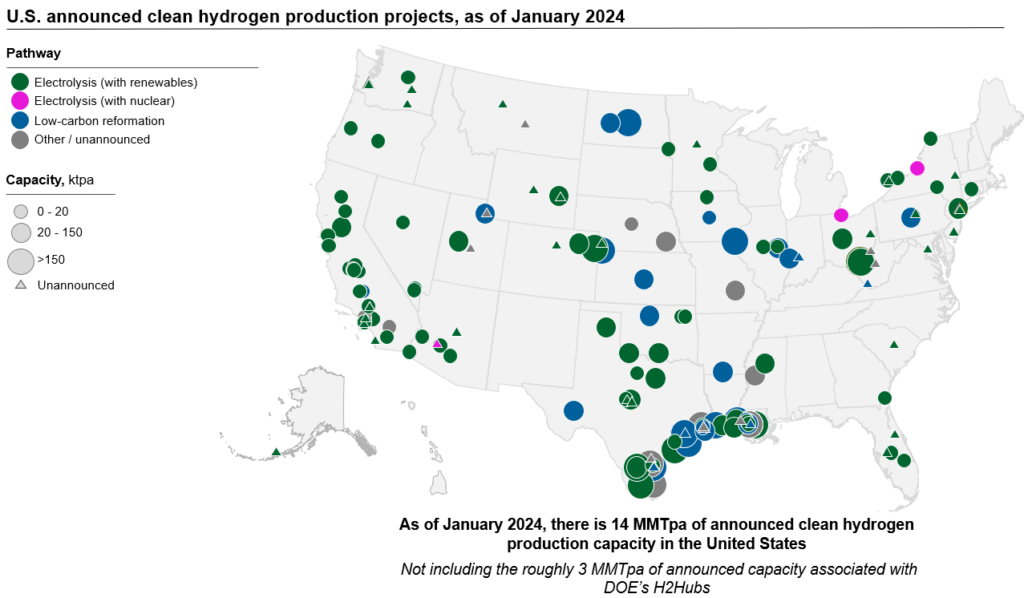

Clean hydrogen production is on track to scale from less than 1 million metric ton per annum (MMTpa) today to 7-9 MMTpa by 2030. This includes roughly 3 MMTpa from DOE’s 7 Regional Clean Hydrogen Hubs, which have been selected and are in the process of being awarded.

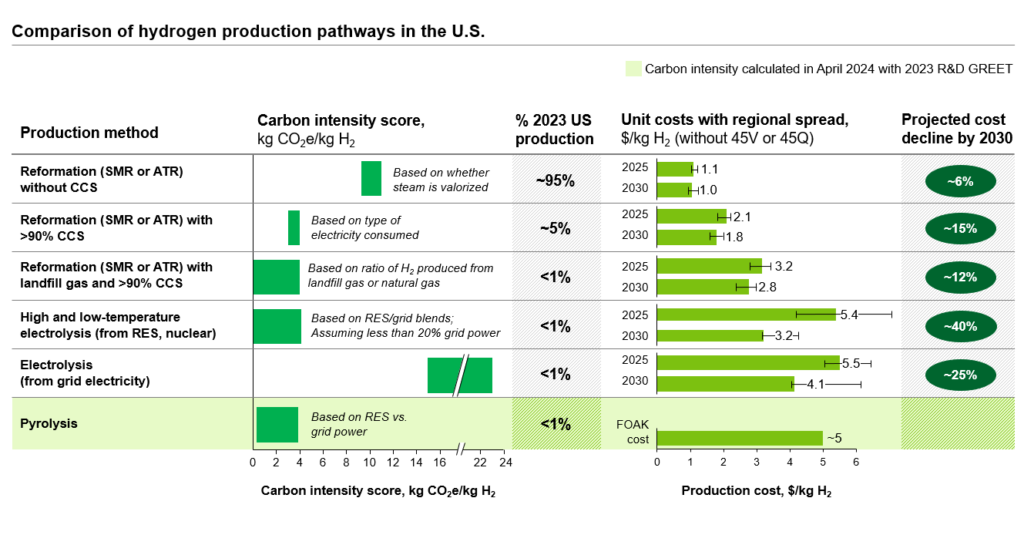

To bring this production online, long-term offtake agreements must be signed. Offtake has been limited primarily due to clean hydrogen’s high production costs. Today, clean hydrogen costs between 2-7x more than unabated fossil-based clean hydrogen. State-level and federal incentives in the Bipartisan Infrastructure Law (BIL) and Inflation Reduction Act (IRA) help make clean hydrogen more cost-competitive with incumbent technologies for numerous applications. Additionally, some of the higher costs associated with clean hydrogen production, like financing costs, are expected to decrease over time.

In the current policy environment, commercial liftoff for clean hydrogen is expected to take place in three phases:

2023-2026

Near-term expansion

Accelerated by the Inflation Reduction Act’s 45V production tax credit, clean hydrogen replaces carbon-intensive hydrogen in select industrial use cases or in export markets. This shift will primarily occur at co-located production/demand sites, industrial clusters with pre-existing hydrogen infrastructure, or in areas with abundant renewable energy sources. The pace of clean electricity deployment will be a key driver of hydrogen production technology mix. For water electrolysis, availability of clean electricity and bottlenecks in electrolyzer components/raw materials will play a critical role in the pace of growth. In parallel, first-of-a-kind projects are expected to break ground, driven by $8B in DOE funding for Regional Clean Hydrogen Hubs that will advance new networks of shared hydrogen infrastructure.

2027–2034

Industrial scaling

Hydrogen production costs may decrease with lower electricity costs, lower inflation, and accelerated learning curves. Build-out of midstream distribution and storage networks will connect a greater number of producers and offtakers, reducing delivered cost and driving adoption in new sectors. Each sector converting to clean hydrogen will also face its own opportunities and challenges. For example, fuel cell heavy-duty truck adoption will depend on the build-out of refueling infrastructure, advancements in fuel cell vehicle technology, certainty of hydrogen supply, regulation, and the cost of alternatives (e.g., battery electric vehicles).

2035+

Long-term growth

Post-45V expiration, a scaled clean hydrogen market sees unsubsidized production costs decline from $2-7/kg today to $1-2/kg by 2035. Development of mature financial structures and contract mechanisms to mitigate the remaining risks (e.g., price volatility) and crowd-in institutional capital will also be needed.

Cross-cutting solutions, including DOE H2Hubs, will accelerate market uptake:

Invest in the development of hydrogen distribution and storage infrastructure

initially through centralized hubs and later through distributed infrastructure. Dispersed infrastructure will unlock use cases for hydrogen where production and offtake are not co-located.

Catalyze supply chain investments

including in domestic electrolyzer manufacturing and recycling.

Develop regulations for a scaled industry

such as project permitting and siting reform and lifecycle emissions analysis across emerging feedstocks and production pathways. These policy and regulatory developments would take place across both federal and state agencies.

Standardize processes and systems across the clean hydrogen economy

like standard operating procedures (SOPs), certifications, and component interoperability (e.g., at refueling stations) in partnership with private sector organizations to accelerate project development.

Accelerate technical innovation through R&D

to bring down costs and mitigate bottlenecks in some technologies (e.g., platinum group metals for PEM electrolyzers). R&D is also needed to bring down the cost of carbon capture, utilization, and storage for reformation-based production as well as in end-use applications such as improving fuel cell durability.

Expand the hydrogen workforce

through the engagement of both companies with preexisting expertise in safe hydrogen handling (e.g., oil & gas companies, chemicals companies) and labor unions with the skilled workforce and relevant training programs.

Expand and accelerate the capital base

using mechanisms that manage price and volume risk (e.g., price discovery via a hydrogen commodity market, hedging contracts) and encourage long-term offtake. DOE has reserved a portion of its Clean Hydrogen Hubs funding to develop a demand-side support function to scale clean hydrogen demand.

The U.S. Department of Energy, in partnership with other federal, state, and local agencies, has tools to address challenges to commercial liftoff and is committed to partnering with the private sector to lead the commercialization of affordable energy resources while proactively responding to the nation’s growing energy demand.