The pathway to:

Carbon Management

Commercial LiftOff

Modeling studies suggest reaching U.S. energy transition goals will require capturing and storing 400 to 1,800 million tonnes (MT) of carbon dioxide (CO2) annually by 2050, through both point-source carbon capture, utilization, and storage (CCUS) and carbon dioxide removal (CDR).1 Today, the U.S. has over 20 million tonnes per annum (MTPA) of carbon capture capacity, 1–5% of what could be needed by 2050.2,3 This scale-up represents a massive investment opportunity of up to ~$100 billion by 2030 and $600 billion by 2050.

America’s more than 20 MTPA of capture capacity already leads the world in carbon management, and the U.S. is an attractive policy and resource environment for further deployment. An increase in the value of the 45Q tax credit—a federal tax credit provided for stored or utilized CO2—has provided a greater incentive and more certainty to developers and investors and is likely to yield attractive returns for several types of projects.4 In addition, recent climate and infrastructure legislation has provided ~$12 billion in funding to support U.S. carbon management projects. The U.S. has excellent geology for storing CO2, world-class engineering and professional talent, and relatively abundant low-cost zero-carbon energy resources that can power carbon dioxide removal (CDR) projects to maximize net carbon removed.

Many large-scale carbon management projects are already proving financially attractive today with enhancements to the federal 45Q tax credit, and investors have raised billions to take advantage of these opportunities.5,6 These investments range from early-stage equity in carbon capture technology providers to large-scale private equity-backed investments in CO2 transport infrastructure.

There are two pathways to meaningfully scale carbon management through near-term and longer-term opportunities.7,8,9

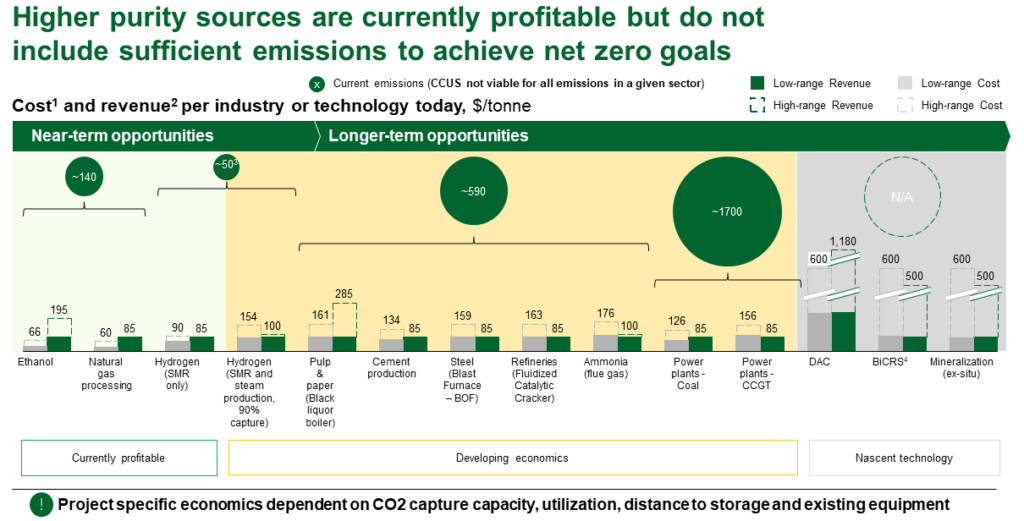

Displayed cost estimates based on EFI Foundation capture costs with transport (GCCSI, 2019) and storage (BNEF, 2022) costs of ~$10-40/tonne, except where noted. All in 2022 dollars. All CCUS figures represent retrofits, not new-build facilities. The lower bound costs represents a NOAK plant in a low cost retrofit scenario with low inflation. The higher bound costs represents a FOAK plant in a high cost retrofit scenario with high inflation. The inflation variance on each cost estimate represents the range of cost increases on a generic chemical processing facility due to inflation from 2018 using the Chemical Engineering Plant Cost Index (CEPCI).

Revenues based on applicable mix of 45Q tax credit, Low Carbon Fuel Standard, Voluntary Carbon Markets and the 45V tax credit (which cannot be stacked with 45Q). Other sources of revenue (e.g., premium PPAs, EOR) are discussed in more detail in the appendix. Tax credit values do not reflect expected discounts to the face value of the credit associated with tax equity financing or transferability. For retrofits, revenue does not reflect the value of products already sold by the facility (e.g., electricity from an existing power plant)

Current hydrogen capacity is likely to grow with the growth of reformation-based capacity and future demand likely

Includes BECCS to power, biochar, and bio-oil; Biochar and bio-oil may not be eligible for 45Q

Concentrated sources of CO2 (e.g., in ethanol or hydrogen Steam Methane Reformer (SMR) capture facilities) are currently profitable but do not include sufficient emissions reductions alone to achieve net zero goals

~2023-2030

Near-term opportunities

For near term opportunities (i.e., through 2030), projects in industries with high-purity CO2 streams (e.g., ethanol, natural gas processing, hydrogen) have the best project economics and many projects are in active development or are already in operation. Large-scale transportation and storage infrastructure is likely to emerge to serve these projects. These developments—along with some promising demonstration projects in higher-cost carbon management applications (e.g., steel, cement)—will lay the foundation for more widespread deployment by establishing best-practices in contracting, financing, permitting, community engagement, labor agreements, workforce development, and, in some cases, through building out common carrier transport and storage infrastructure that future projects can use.

~2030+

Longer-term opportunities

Progress across near-term and longer-term opportunities could create commercial liftoff between now and 2030 as project finance mechanisms become de-risked, a robust ecosystem of enabling transport and storage infrastructure matures, state and federal regulatory requirements promote lower-GHG alternatives, and capital markets become comfortable with carbon management projects as an asset class.

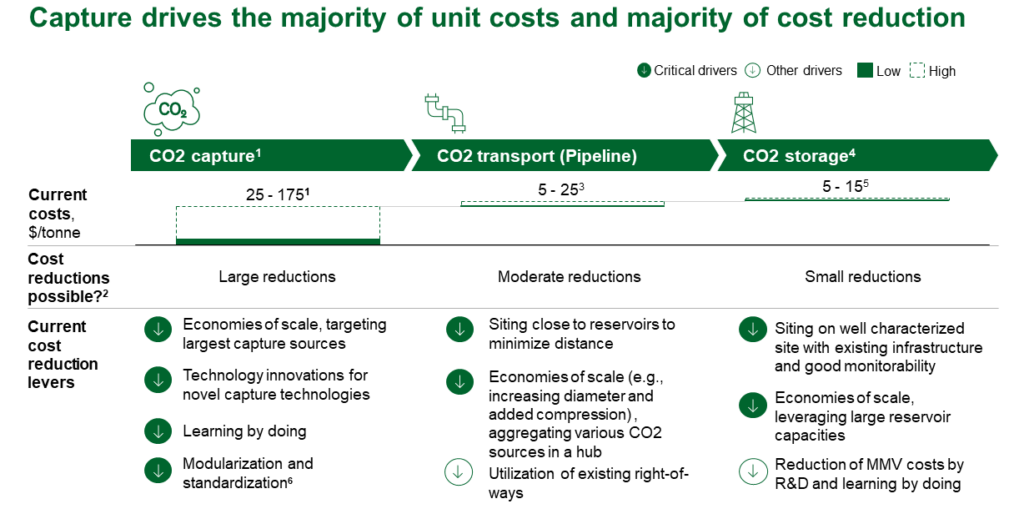

Refers to CO2 capture broadly across sectors examined in this report (see Figure 1); Costs drawn from EFI Foundation, “Turning CCS Projects in Heavy Industry & Power into Blue Chip Financial Investments”

Refers to CO2 capture broadly across sectors examined in this report (see Figure 1); Costs drawn from EFI Foundation, “Turning CCS Projects in Heavy Industry & Power into Blue Chip Financial Investments”

Generalized across sectors. Individual sectors will have sector-specific cost reductions

Approximate costs based on published studies by the European Zero Emission Technology and Innovation Platform, the National Petroleum Council, and GCCSI process simulation for a 30 year asset life. All costs have been converted to a U.S. Gulf Coast basis. Lower end of pipeline cost assumes 20 MTPA, 180 km onshore pipeline. Upper end of pipeline cost assumes 1 MTPA, 300 km onshore pipeline.

Utilization routes also exist including, but not limited to, conversion of CO2 into synfuels or plastics and utilization of CO2 in EOR and building materials

Figure represents a levelized cost of site screening, site selection, permitting & construction, operations, and site closure and post-injection site care

Modularization will be a more critical driver for certain technology types than for others

Capture drives the majority of unit costs for CCUS and represents the majority of cost reduction potential.

The challenges facing widespread deployment of carbon management are real but solvable

Increasing the transparency and certainty of the voluntary and compliance markets for CDR can increase market support. Two factors could create long-term revenue sources: (1) regulations that favor CDR deployment and (2) increased technology premiums for CDR driven by end-user demand. Project funding and demand-side market support from DOE could help stabilize the market for CDR developers and investors.

Projects developed today can build out CO2 transportation networks and storage facilities that can serve as shared infrastructure for future carbon management projects located nearby. The DOE will support development of shared storage facilities and transport infrastructure through Bipartisan Infrastructure Law (BIL) funding.

Addressing these concerns, including environmental justice considerations, requires commitment to responsible carbon management from policymakers and industry to build trust with communities considering carbon management projects. Developers must anticipate, listen to, and address stakeholder concerns through early, substantive, and transparent engagement on the benefits and risks of these projects.

DOE’s Office of Fossil Energy and Carbon Management (FECM) has launched a domestic engagement framework to outline its vision for successful engagement.x The framework provides the guiding principles to ensure that tangible environmental, economic, and social benefits flow to communities. Additionally, DOE has added requirements for carbon management funding opportunity applicants to incorporate community engagement; diversity, equity, inclusion, and accessibility; environmental justice; and quality jobs plans into their applications and project plans.

Carbon management is experiencing a once-in-a-generation opportunity given the current policy and market environment. The 45Q tax credit provides certainty and attractive project economics for several project types. Funding for commercial demonstration and deployment projects in BIL and the Inflation Reduction Act (IRA) could spur carbon management projects in industries in which project economics would otherwise still be challenging, providing investors with sector-specific blueprints for project finance. Substantial and responsible investment in carbon management deployment over the next decade can prove out business models and generate the community, market, and policy buy-in that carbon management will need to contribute meaningfully to the nation’s energy future.

The U.S. Department of Energy, in partnership with other federal, state, and local agencies, has tools to address challenges to commercial liftoff and is committed to partnering with the private sector to lead the commercialization of affordable energy resources while proactively responding to the nation’s growing energy demand.